Infrequent Investment Ideas Vol.2: Why Buy TSMC’s Stock (TWSE: 2330)?

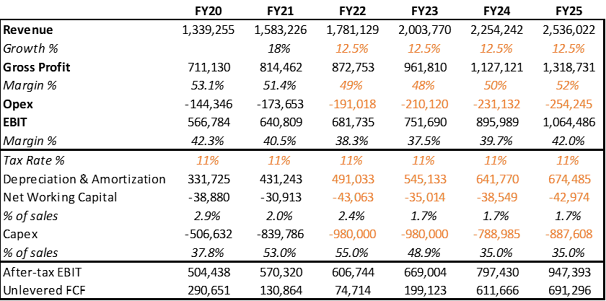

TSMC’s management raised their guidance for FY21 revenues on the 2Q21 earnings call and told investors that they expect revenue growth through 2025 to be towards the higher end of the earlier provided range of 10-15%/year. This will require investments of $100bn through FY23, which will be TSMC’s most intense investment period this century, not only in absolute terms but also relative to sales. Management, nevertheless, discussed maintaining or even improving (average) profitability through FY25. If this guidance is met, TSMC will logically compound EBIT at 10-15% during the next 4 years to NT$1.064bn at mid-point. Depending on one’s assumptions about capital intensity after FY23, unlevered free cash flow could more than double from the FY20 level. Exhibit 1: My estimates of TSMC’s operating results in FY20-FY25 (in NT$m) implied by guidance; assumptions are in orange If those investments generate returns similar to what TSMC has averaged over the past 10 or even 20 years (25% av...