Infrequent Investment Ideas Vol.2: Why Buy TSMC’s Stock (TWSE: 2330)?

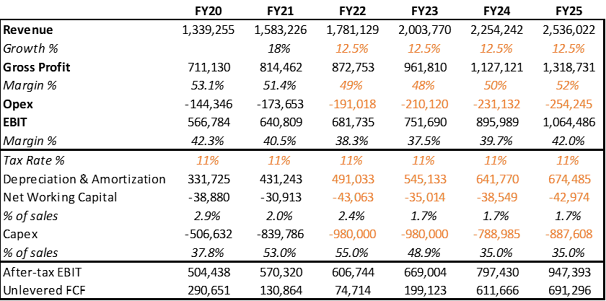

TSMC’s management raised their guidance for FY21 revenues on the 2Q21 earnings call and told investors that they expect revenue growth through 2025 to be towards the higher end of the earlier provided range of 10-15%/year. This will require investments of $100bn through FY23, which will be TSMC’s most intense investment period this century, not only in absolute terms but also relative to sales. Management, nevertheless, discussed maintaining or even improving (average) profitability through FY25. If this guidance is met, TSMC will logically compound EBIT at 10-15% during the next 4 years to NT$1.064bn at mid-point. Depending on one’s assumptions about capital intensity after FY23, unlevered free cash flow could more than double from the FY20 level.

Exhibit 1: My estimates of TSMC’s

operating results in FY20-FY25 (in NT$m) implied by guidance; assumptions are

in orange

If those investments generate

returns similar to what TSMC has averaged over the past 10 or even 20 years (25%

average RoIC[1] over the past 10 years, 23%

over the past 20), the FY25 guidance is not only within reach but appears disappointing.

TSMC’s management are among the industry’s best, and they don’t make such bold

predictions often. Considering the cyclical/volatile nature of the

semiconductor industry, this guidance is indeed bold in terms of both its

duration and growth rate. Rosy as these predictions might seem, they likely

understate management’s real expectations. This sounds speculative, but the

industry’s technology roadmap and TSMC’s positioning in the industry lend this

guidance a lot of credibility.

For most of the past 10 years,

TSMC’s stock traded at around 14x EV/NTM EBIT, until FY19, when it became blindingly obvious that Intel’s

10nm problems have set it back years (the number is up for debate) behind TSMC

in terms of manufacturing capabilities. Intel’s sole competitor in x86

CPUs, AMD, has since been enjoying TSMC’s process advantage, gaining share in

consumer CPUs and making inroads in the server market.

The pandemic-induced boom in

compute demand and the 5G ramp then propelled TSMC to 25% revenue growth in

FY20, marking the company’s fastest growth since FY14, when TSMC replaced

Samsung as Apple’s fab of choice for the iPhone processor. TSMC’s stock

continued rerating up, and it started FY21 trading at ~26x EV/LTM EBIT after

TSMC reported 4Q20 results. It then sold off a bit and has traded at ~20x

EV/LTM EBIT for most of this year, despite management’s FY25 guidance

announcement and the raise of that guidance on the 2Q21 call.

The achievement of management’s

guidance would probably mean that TSMC has extended or at least maintained its

technological lead over Intel and Samsung. This, in turn, would imply plenty of

opportunity for growth beyond FY25 (maybe a bit slower considering the FY25

base). So, what would TSMC be worth then, and, hence, what is it worth now?

Exhibit 2: TSMC’s EV/NTM EBIT over

the past 10 years

Source: TIKR.com

The below table summarizes the

potential values for TSMC’s EV at the end of FY24, depending on what multiple

the market would ascribe to its FY25 EBIT of NT$1.064bn. This, of course, would

be dependent on a few factors, including the interest rate environment, but

companies in quasi-monopoly positions in industries with secular tailwinds rarely

get optically cheap. At 25x-30x FY25 EBIT, TSMC’s FY24 MV would offer 19-27%

compounded annual returns, not even factoring in dividends (historically ~50%

of net income). At the risk of stating the obvious, this is a fantastic rate of

return, so why hasn’t at least some of it been arbitraged away?

Exhibit 3:[2]

Future value of TSMC’s FY24 MV (in NT$m) and implied compounded return from

current MV

It appears the market is

currently placing fairly low odds on the company meeting its guidance, and we

need to understand why. To do this, first we must answer the question, “What

needs to happen for TSMC’s guidance to be met?” Though this is a bottom-up

fundamental analysis memo, some top-down thoughts would help us arrive at the

answer in broad strokes.

TSMC is the world’s largest

foundry with ~55-60% market share and is close to a monopoly in leading-edge

foundry services. Foundry demand is driven by the broader semiconductor market.

TSMC’s growth in any given year has long been entirely driven by revenues from

what were at the time leading-edge processes, with lagging-edge processes

typically declining year-on-year (2021 is a bit abnormal). Since TSMC’s share of

the foundry industry exceeded 50% in 2014, it follows that TSMC’s leading edge

growth has accounted for more than half of the foundry industry’s growth. This,

of course, makes sense in the context of Moore’s Law. The table below summarizes

the growth trends of the semis and foundry industries over the past 20 years.

Exhibit 4: Growth trends of total

semiconductor sales and foundry sales

So, the conditions sufficient/required to be met for TSMC’s guidance to be realized would be:

1) The semiconductor industry, and the leading-edge subset in particular, continuing to grow at a rate similar to its 5-year CAGR for the next 5 years;

2) TSMC at least maintaining its current market share of the foundry market and the leading-edge subset in particular;

3) TSMC continuing to deliver enough value to its customers to at least maintain its current economics/profitability profile.

Therefore, the substantial gap

between price and value suggests the market is pricing all three being met as less

than likely. Though the semiconductor industry has historically been cyclical

and will most probably continue to oscillate between boom and bust, and the

current shortage will probably turn into a glut at some point, the secular

trends[3]

arguably accelerated by the pandemic incline me to believe that the market is

not discounting 1) as unlikely. Discussing 1) would be too much of a top-down

endeavor or an overwhelming collection of bottom-up tasks for each large

semiconductor company and so 1) is ticked off as quite likely for the purposes

of this analysis. Then the risks to 2) and 3) can be distilled to:

- Intel, Samsung, SMIC, and/or an upstart foundry

catching up to and/or surpassing TSMC in technological capabilities and gaining

share of the leading-edge foundry market by offering a better value proposition

to customers;

- Geopolitical calculations altering the semiconductor fabrication landscape either through preferential treatment for domestic foundries in the U.S. and Europe or an outright Chinese invasion of Taiwan.

Assessing the likelihood of 2)

and 3) transpiring is very much a bottom-up process. The rest of this memo

discusses some recent industry developments and TSMC’s competitive advantages

(with references to Hamilton Helmer’s “Power” framework), which, taken together,

inform my hypothesis that the risks listed above are unlikely to pose a

significant threat to the FY25 guidance being met or exceeded and that TSMC

would be able to fend off any additional threats should they arise. This would

make TSMC’s potential EV in the next few years (and its present value today)

quite attractive relative to the current stock price.

Semiconductor Capital Intensity/The End of Moore’s Law

Over the past 20 years, semiconductor revenues and silicon shipments have moved in lock-step, while transistor (silicon area) density, performance, and power efficiency have improved roughly as predicted by Intel co-founder Gordon Moore. The increase in transistor density has meant that a consistent price/square inch of silicon translated to lower price/transistor, better performance/watt, or simply higher and more energy-efficient performance per dollar.

Exhibit 5: Industry revenues (in $m)

and silicon shipments (in millions of square inches)

However, the physics problems to

be solved for this progress to continue have been increasing in difficulty.

Hence, Moore’s Law’s progress has been predicated on increasing R&D investments

on the part of wafer fabrication equipment (WFE) manufacturers, which, combined

with the industry’s cyclicality, has been a spell for consolidation. Today, the

top 5 companies (Applied Materials, ASML, Lam Research, Tokyo Electron, and

KLA) account for 2/3rds of WFE revenues and spent $8.4bn on R&D in CY20,

about 2% of the entire semiconductor industry’s revenues. These companies have

held the keys to improving performance and, hence, charge sufficiently high

prices to earn great returns on these R&D investments.

The rising costs of

manufacturing, coupled with the cyclicality of the industry, dissuaded a lot of

the IDMs from participating in leading-edge manufacturing, and foundries picked

up the capex tab but also claimed a larger pie of industry revenue to be compensated

for their troubles.

Exhibit 6: Wafer Fabrication

Equipment and foundry sales as % of total semiconductor revenue

As a result, for the past 5 years

or so, as improving transistor density has been approaching its physics

limitations,[4]

the rate of performance improvement has slowed below the rate predicted by

Moore’s Law, and these slowing improvements have been increasing in cost.

The higher equipment bills and

the slowdown of transistor scaling have, logically, led to an increase in the

cost per transistor at the leading edge.

Exhibit 7:[5]

Transistor costs are rising

There is further nuance to

equipment costs – a significant amount (as much as 95%[6])

of tools used in one process node can be reused in the next process node

(lowering costs), but the leading-edge foundries are also adding capacity

(increasing costs), and every new node has required more processing steps,

requiring more/newer/more expensive equipment to achieve the same

throughput/capacity (increasing costs). Of course, with the introduction of EUV,

the degree of equipment reuse has decreased significantly. On balance, each new

node has proved more expensive for foundries.

Exhibit 8: Relative production costs

by process node

Exhibit 9: My estimates of greenfield

capex per 1,000 wafer starts per month of capacity

Source: TSMC, Applied Materials, SIA, Tokyo Electron, DigiTimes

The discussion of manufacturing

costs has so far focused on the challenges and costs of fitting more

transistors on a square millimeter of silicon and, hence, the front end of

manufacturing. The back end, namely packaging, has long been a performance

bottleneck, perhaps overlooked because of the reliable performance improvement

in accordance with Moore’s Law at the front end. At the risk of oversimplifying,[7]

this limitation stems from the necessity of chips to communicate with other

chips through metal interconnects and substrates, and the improvement in the

density of those has significantly lagged transistor scaling. The industry has

turned to packaging for the next wave of performance improvement, as transistor

scaling nears its physical limits. Advanced packaging techniques have provided

vital alternatives to large monolithic dies (with all the associated

manufacturing issues at advanced nodes) in computing (chiplets used by AMD and

Intel) and enabled revolutionary antenna technologies for 5G devices.

Historically a small sliver of

WFE (typically <10%), back-end equipment is becoming an increasingly

important corner of semiconductor manufacturing equipment. There are two pieces

of good news for foundries: 1) packaging is becoming more tightly coupled with the

front-end of manufacturing[8]

in which foundries specialize, and 2) advanced packaging could bring the next

wave of performance improvement beyond Moore’s Law.

Exhibit 10: The next decade in

manufacturing, according to a major advanced packaging equipment manufacturer

The bad news is that its costs

are incremental and not a substitute for front-end equipment.

Exhibit 11:[9]

Relative production costs by process node, front-end and back-end

The rising WFE bill has caused

consolidation at the leading-edge after Globalfoundries bowed out of the race

to 10nm. Today, only a handful of players are willing and able to pay the

eye-watering equipment bills for production capacity at the leading-edge (and

make it work): Intel, Samsung, and TSMC, with Intel struggling to catch up to

Samsung and TSMC. Of these, TSMC is the only pure foundry and arguably (Samsung

would argue) has the most advanced process in what it calls 5nm.

Exhibit 12: Share of non-memory wafer

production by process node

Exhibit 13: Top two companies’

spending as a % of total WFE sales

The challenge that foundries are

facing is delivering enough value to customers through silicon performance

improvements at an acceptable yield in order to charge wafer prices sufficient

to earn an attractive return on the ever-increasing investments required at the

leading edge.

TSMC’s Competitive Advantage #1: Shared Scale Economics

Pricing

TSMC is not maximizing profits.

Articles about TSMC’s 20% in wafer prices often fail to mention the costs

involved in building out capacity for these wafers. One could argue that TSMC

earned the right to extract huge value from its customers, since TSMC put a lot

of capital at risk to push the envelope of leading-edge manufacturing and build

out capacity, but that’s not consistent with TSMC’s business philosophy. The

company’s management has taken a different path. They refer to customers as

partners and explain their pricing decisions as “strategic, not opportunistic.”

Management has long realized the value of co-developing processes with

customers and that such collaboration and opportunistic pricing are not

congruent.

This is clear from a quick look

at TSMC’s financial statements – RoIC has been relatively stable over the past

20 years, even as the company has become the clear leader at the leading edge.

The benefits from TSMC’s superior processes and economies of scale are

shared with customers to assure an industry-leading value proposition.

The years of slightly higher

returns preceded periods of substantial investments, so the profits made in

those higher return periods were used to finance the increased capital

expenditures (TSMC has maintained net cash positions for at least the past 20

years). This has been well understood by leading-edge customers, such as Apple,

for whom an industry-leading technology roadmap, supported by sufficient

capacity, is a key aspect of suppliers’ value proposition.

Apple, for example, does not have

an alternative to TSMC at 7nm and below. Apple initially left Samsung because

Samsung is its major competitor and was tempted to take a peek at its IP. This

dynamic is extant today but is no longer the only reason Apple has stayed with

TSMC as its sole manufacturer of the A-series processors. Samsung could

arguably no longer provide the same performance at the leading-edge, does not

have sufficient capacity for external customers, and lacks the packaging

processes Apple co-developed with TSMC. TSMC could charge Apple a lot more than

$17-20k[10]

per wafer at 5nm… at least for a few years.

A deeper look into the customer

relationship with Apple would serve well to illustrate the value TSMC offers to

its customers, derived from its shared scale economics strategy.

Apple is usually the first

customer of TSMC’s latest process node. TSMC sent hundreds of engineers to

Cupertino in 2013 to work with Apple on its transition from Samsung’s foundry

services.[11]

This close collaboration has continued ever since, and Apple is an important

contributor to key parts of the technology development. Apple has a very big

incentive to make these contributions, considering the leading-edge capex

requirements discussed earlier – it simply wouldn’t be feasible for Apple to go

completely vertical and manufacture its own chips, unless it’s prepared to lose

money in the endeavor.

Here’s why.

Assuming one knows the die size

of an A-series processor, the iPhones’ (and now Macs’) workhorse processor, the

process node on which it is manufactured, and the die’s yield, one can make enough

estimates to illuminate the economics faced by TSMC and Apple and, therefore,

to assess who gets what value in the relationship. These estimates, however,

rely on a number of assumptions and so are only as good as those assumptions,

but hopefully the logic behind both assumptions and estimate calculations is

sound.

Let’s take the A14 and A15

processors of the iPhone 12 and 13 series, respectively, which are both manufactured

on TSMC’s 5nm process. Some public data[12]

on TSMC’s 5nm defect rate/cm^2, which is a key component in yield calculations

(to be discussed in more detail later), reveals that 5nm initial defect rates at

high volume manufacturing were actually better than 7nm ones, and the rate of

yield improvement was comparable, so TSMC probably achieved better initial

yields on the A15 processor, despite its larger die size. Net, TSMC probably

managed to squeeze more A14s out of a wafer on the 5nm process due to the

smaller die size.

Estimates of unit sales of the

iPhone 13 (not mine) suggest it would be selling better than the iPhone 12 in

the holiday season. Here comes a key part of the TSMC-Apple relationship. Demand

for the latest iPhone is seasonal and fleeting, but TSMC needs to build enough

capacity to satisfy that peak demand. It appears the A12 sold about 60m units

in 4Q20, which I assume means TSMC had had to build peak capacity for 40

million phones (pre-building some inventory). If the A13 does sell 80 million units

(as rumored) in calendar 4Q21, TSMC probably needs to have built peak capacity

for 55 million phones. It’s evident from earnings calls that peak capacity

planning is top of mind for management, and I’ll discuss the reason shortly.

Exhibit 14: My estimates of A14 and

A15 peak capacity needs; assumptions are in orange

The table above suggests that TSMC must increase capacity by

37.5% for the iPhone 13, but since iPhone sales are seasonal and dominated by

the newest models in the quarters of and following their release, the iPhone 12

will require significantly less than peak capacity after iPhone 13’s release. Assuming

that after 2022 the iPhones 12 and 13 decrease in volume at a rate similar to

that of the iPhone 11, one can estimate wafer demand in the next 5 years, which

is the period that TSMC uses as the equipment’s useful life in accounting for

depreciation.

Then, using the capex/1,000 wafer starts per month (kwpm),

one can estimate how much TSMC must spend to build out this capacity. TSMC

plans to spend about $400m/kwpm to build out its 5nm fab in Arizona. However,

the Arizona fab buildout will be starting from scratch (greenfield). TSMC’s 5nm

capacity in Taiwan uses a lot of existing infrastructure, as well as a

significant amount of 7nm tools (about 90% of tools can be repurposed, per

TSMC’s comments). EUV is a larger part of the 5nm process, so there is still a

significant incremental investment. I assume $200-$250m/kwpm. Finally, using

TSMC’s disclosure, one can estimate labor costs and variable costs/wafer. The

results are summarized in the table below (continues on the next page).

Exhibit 15: Illustration of TSMC’s

iPhone 12 and 13 economics excluding opex; assumptions are in orange

This analysis is for illustrative

purposes only, and all corrections are welcome. It aims to illustrate that TSMC

takes on the huge costs of building out sufficient capacity for Apple, who only

use the full capacity for no more than two quarters. The result is that TSMC

will be burning a significant amount of cash in the first two years (and this

is before considering opex) unless it finds enough customer demand to

fill the capacity after satisfying Apple’s peak demand. Any miscalculation in

peak capacity planning costs dearly. Foundries live and die by yield and

utilization, and how utilization impacts per wafer economics is illustrated

below (opex excluded from cost assumptions and estimates).

Exhibit 16: Illustration of wafer

unit economics, excludes opex

With each new node, it appears TSMC sets a new record for

the number of customers it has secured on the node. These customers’ products

also target a diverse set of applications and end-markets – from smartphone

processors and notebook CPUs to specialized AI and crypto mining data center

processors. Thus, wafer demand volatility is smoothed out to an extent. This

allows TSMC to plan accordingly and set wafer prices at levels that offer such

value to each customer that it makes it really hard to think of how a rival can

compete. Using the data presented above, I estimate that Apple pays ~$40-50

per chip for A15, which powers a phone whose (rumored) bill of materials is

~$500 and is selling for >$1,000 – shared scale economics at work.

Competitive Advantage #2: Process Power/Superior Technology

I discussed one of the two major

operational factors dictating a fab’s profitability, namely utilization. The

other one is yield. Fitting square chips on a circular wafer means that a

portion of the wafer is lost at the edges. Additionally, each step of the

manufacturing process faces some probability that a defect occurs somewhere on

the wafer. A defect renders the chip on which it occurred (at least partially)[13]

useless. The wafer’s yield is the percentage of the wafer area that is defect-free.

The yield of a chip (or die) is the number of defect-free (good) chips as a

percentage of the maximum number of chips that can theoretically fit on a

defect-free wafer. A larger die size means fewer chips can be fit on a wafer,

so one defective chip represents a larger percentage loss (compared to a

smaller chip). Hence, chip yield and chip die size are inversely related for a

given defect rate.

Exhibit 17: Basic die yield equation

Source: From the book Extending

Moore’s Law through Advanced Semiconductor Design and Techniques

Wafer purchase agreements between

foundries and their customers are confidential and differ from customer to

customer, but all customers are in the business of selling or using

non-defective chips, so these agreements usually stipulate a minimum acceptable

yield. If the foundry fails to deliver, it has to make the customer whole

through either monetary compensation or extra wafers. In effect, the customer

wants to guarantee the delivery of a certain number of chips for its money

(price/chip). Volume discounts are also features of the typical wafer purchase

agreement.

The basics of yield economics are

summarized by the equation below. It simply formalizes the fact that a foundry will

have to process more wafers to deliver the same number of chips (earn the same

revenue) as a foundry achieving better yield.

Exhibit 18: Basic relationship between

wafer cost and die yield

Of the variables in the basic

yield equation, the one that’s within a foundry’s control is the defect rate. Minimizing

defect rates has a learning curve for each node, and since the majority of

tools used in a given node can be repurposed for the next node, the learnings

cumulate across nodes. Hamilton Helmer would term this hysteresis – “[the]

process advances are difficult to replicate, and can only be achieved over a

long time period of sustained evolutionary advance.”[14]

Not only is leading-edge yield a

product of hysteresis, but the difficulty of achieving it at every node is

growing exponentially. Referring back to the die yield equation, die yield is

decreased by each additional critical mask layer (through a power law), and

each mask layer requires several processing steps. The figure below illustrates

the rise in the number of processing steps at leading-edge nodes. Whether the

defect rate at each processing step is probabilistically dependent on or

independent of other steps, each step entails some probability of a defect

occurring. To achieve yields of 90% at 5nm, a foundry must execute more than

1,000 incredibly sophisticated processing steps near perfectly, and this is

exactly what TSMC does.

Exhibit 19: Number of process steps

per wafer at the leading-edge

Source: Fabricated Knowledge, CMC

Materials Investor Day

What’s even more impressive and terrifying for competitors is that the accumulation of manufacturing expertise in one node often helps achieve better yields on the next one. The learning curve for TSMC’s 7nm and 5nm processes is illustrated below.

Exhibit 20: TSMC’s 7nm and 5nm defect

rate progression

Advanced packaging[15]

is not a substitute for front-end complexity at the leading edge but rather

layers on additional complexity. Manufacturing smaller leading-edge chips

(chiplets) to package together might improve individual die yields and costs,

but packaging the chiplets also has a yield of less than 100%. Additionally, manufacturing

two different chips with yields of 90% each are probabilistically independent

events and packaging them together has a yield of 81%, on average, even if you

assume 100% packaging yield. For sophisticated computing chips with large die

sizes near the reticle limit, large monolithic chips might not be feasible at

all, so advanced packaging of chiplets might be the only solution.

Advanced packaging is analogical

to the leading-edge in the back-end, and it has its own engineering challenges,

more mechanical than chemical/optical when compared with the front-end. TSMC is

well on its hysteresis path in advanced packaging as well after pioneering

fan-out packaging (InFO) of logic in high volume with Apple back in 2016.

Finally, there is the issue of

cycle times or throughput.[16]

RoIC is the product of asset turnover and operating margin, and wafer capacity

is similarly a product of throughput and yield. Therefore, the return on the

huge equipment investments discussed earlier is a function of both yield

(non-defective chips/wafer) and throughput (wafers processed/unit of time).

A semiconductor fab is a collection

of numerous tools from various vendors. Each tool has a maximum theoretical

throughput, and it’s the foundry’s job to get as close to that throughput within

a certain defect rate envelope. Processing times per mask layer vary between

foundries, and the best foundries take 20-50% less time than average or

below-average foundries. These time savings really add up at the leading edge with

the large number of steps involved.

However, according to ASML, the

biggest contributor to cycle times is the wait times between steps. Wait times

also tend to increase with fab utilization. Consequently, process flow

automation and optimization can be real differentiators in productivity and

cost. These, like front-end and back-end defect rate optimization, are also the

result of years of accumulation of expertise or hysteresis.

Competitive Advantage #3: Counter-positioning/Revolutionary

Business Model

This one is fairly

straightforward and well-understood but is hugely important and so merits a

brief discussion. As the world's first pure-play foundry, TSMC had a unique

proposition when it was founded in 1987 - we will only manufacture the chips

you design and will not compete with you by designing and manufacturing our own

chips. The Apple-Samsung IP incident reveals how important this is for

protecting IP. Nvidia and AMD are two of TSMC’s customers who begin using

TSMC’s most advanced process not long after Apple. It’s tough to see what

compels them to use Intel’s foundry services despite all of Intel’s assurances

that the foundry business will be a walled-off entity, separate from Intel’s

own chip business.

Then there is the issue of

capacity prioritization. The pandemic drove huge demand for both consumer and

server CPUs. Would AMD trust Intel Foundry Services to honor its wafer

obligations when Intel’s internal production capacity is running full, and the

mothership is missing out on the unforeseen revenue windfall? Would Intel want

to include adjustable wafer prices in the wafer purchase agreements to be

compensated in such events, and why would AMD sign such a contract? The same

logic broadly applies to Samsung and its chip competitors as well. These are

just some of the questions that the conflicts of interest involved in Intel’s

and Samsung’s foundry ambitions raise.

And if Intel and Samsung are

unable to attract at least some of their competitors as customers, how would they

enlist enough customers and secure enough demand to make the peak capacity

economics discussed above work? And if they can’t make the economics work, how

can they offer low enough prices to have a better or at least comparable value

proposition compared with TSMC’s and so forth.

Competitive Advantage #4: Network Effects

Network effects are usually

associated with Internet platforms, but, effectively an aggregator of leading-edge

demand, TSMC benefits from them, too. “Network effects” simply means the value

of a product or service to each customer increases with the number of customers

using it. There are several network effects in TSMC’s foundry services. First,

the wafer economics described in the shared scale economics section are made

possible by the number of customers whose orders fill the newest node capacity

built for peak Apple demand.

Network effects also exist in the

sophisticated IP ecosystem which TSMC built over the past ~15 years. Once the

initial design is complete, every chip design needs to be qualified for

production, and that process’ complexity increased with the advance of Moore’s Law.

To speed the process up, TSMC launched the Open Innovation Platform (OIP) in

2008. Essentially, it was a library of design kits, IP blocks, and other design

tools, which TSMC had qualified for its design rules.

Shortly thereafter, it also

launched its CyberShuttle service (which it copied from a US academic idea). It

was the industry’s first multi-project wafer service – companies would send

their mask designs to TSMC, and TSMC would use them to produce many different

chip designs on the same wafer, cut the chips up, and send them back to the

customers for verification; this would greatly reduce mask design costs as

compared to having each company using separate wafers with their own masks for

their prototypes.

CyberShuttle directly reduced

design costs, while OIP reduced time-to-market, which is a real economic cost

for customers.

Both of these initiatives were

copied by competitors, but TSMC had the first-mover advantage. Design software

tools companies like Cadence and Synopsys and IP companies like ARM had the

incentive to work with TSMC to have their tools and IP qualified for TSMC’s

processes, given its large customer base, and new customers or existing

customers expanding product lines chose TSMC for the lower design costs and

short time to market, and so the cycle went. TSMC is today at the center of an

ecosystem of IP companies, design tools makers, front-end and test and

packaging equipment suppliers, and fabless companies. As a result, it has the

broadest IP library and years of learning and co-development of various chips.

Before TSMC’s business model

disrupted the semiconductor industry, IDMs were mostly manufacturing

proprietary chips (they did have some foundry services), so they developed expertise

in the manufacturing of the types of chips in which they specialized. TSMC opened

its doors to all companies and so produced chips with various architectures and

die sizes for a diverse set of applications. Again, this was copied as competitor

fabs emerged, but TSMC again had the first-mover advantage. This exposure

probably helped TSMC with establishing its most important competitive advantage

(together with its shared scale economics pricing philosophy) – its ability to

achieve economically viable yields on industry-leading technology processes.

Conclusion

In the first section of this

memo, I listed what I think are the major risks to TSMC’s business, risks that

could prevent it from achieving its FY25 guidance. After discussing TSMC’s

competitive advantages, I will now briefly discuss why I think these advantages

render the probability of these risks unfolding:

- Intel, Samsung, SMIC, and/or an upstart

foundry catching up to and/or surpassing TSMC in technological capabilities and

gaining share of the leading-edge foundry market by offering a better value

proposition to customers;

Though TSMC spent $3.7bn on

R&D in 2020 (44% more than the largest spender among WFE companies, ASML),

some of its most valuable IP is the product of years of learning from

experience and cannot be found on the balance sheet. But it is an asset that

enables TSMC’s leadership. While a lot of the R&D burden is shared with

customers who make significant contributions to the development of new processes,

TSMC’s manufacturing expertise is a very opaque IP asset that is next to

impossible to reverse-engineered.

Intel and Samsung are

leading-edge powerhouses, as well, but TSMC is a few steps ahead, and that

advantage is difficult to surmount in a hysteresis-driven process. Indeed, TSMC

surpassed Intel, but it took a few years after Intel made the fateful decision

not to use EUV (it has since reversed course). It is possible that TSMC makes a

similar mistake in the future (maybe it’s a mistake to continue to rely on

FinFET transistors as Intel is pushing GAA), but I think its customers have the

incentive to help steer its technology roadmap in the right direction not only

because they face not insignificant switching costs, but also because these

customers are reluctant to use the foundry services of competitors, as

discussed earlier. For now, the rumored negotiations between Intel and TSMC for

Intel to secure capacity at TSMC for its GPU chiplets are a testament to TSMC’s

lead.

Intel is currently mounting an

attack from a position of weakness. The company is now past the stage of denial

about its manufacturing capabilities and has entered the panic phase. Aside

from its technological inferiority and conflicts of interest, there has always

been another problem with Intel’s foundry operations that the company is now

forced to face – Intel has been running at close to 25% free cash flow margin, with

its operating cash flow margin at ~45%. The implication is that Intel is now

facing a much higher capex bill than anything seen in recent memory. Intel’s

gross margins have been a few percentage points above TSMC’s (high 50%s), even

as it has enjoyed lower depreciation/sales. It’s tough to see how Intel doesn’t

take a significant hit to profitability even when its foundry operations

mature. On the other hand, it’s tough to see how Intel reverses the process of

losing share in CPUs to AMD and Apple in the consumer segment, and AMD and all

the hyperscalers in the server segment, and how its core CPU business regains

importance as new computing needs increasingly demand new architectures. Intel

seems to be forced to go all in on the foundry business.

Other competitors, such as

China’s national foundry champion, SMIC, are living proof that simply throwing

money at the problem of achieving economically-feasible yields at the leading

edge is no solution. SMIC is many years behind Intel, Samsung, and TSMC,

despite the seemingly endless subsidies, government incentives, and the constant

influx and exodus of elite managers. The US embargo on EUV tools won’t exactly

help China’s cause either.

- Geopolitical calculations altering the

semiconductor fabrication landscape either through preferential treatment for

domestic producers or an outright Chinese invasion of Taiwan;

Intel’s CEO, Pat Gelsinger, is,

among semiconductor executives, the most vocal proponent of government support

for U.S. semiconductor manufacturing. Mr. Gelsinger preemptively criticized the

future U.S. support TSMC might receive for its Arizona fab, but TSMC’s Arizona

fab plans, which assume some government support, suggest the U.S. government is

more concerned with the geographical location of the fabs than with who their

owner is (as long as it’s not Chinese, of course). TSMC’s management on several

occasions stated that there is no way a US fab can match the economics of its

Taiwan complexes, so government incentives will have to be substantial.

Even with substantial government

support not available to TSMC, Intel and Samsung will still be facing

competitive disadvantages in technology and business model. Government

incentives might solve the capital intensity problem for Intel, but they won’t

solve the technological problems. Western governments also move slowly,

especially when it comes to big spending bills, and meanwhile TSMC will be advancing

ahead.

Lastly, the risk of China

invading Taiwan seems to have increased in the minds of Western leaders. This

would be, as Jon Stokes puts it, “a catastrophe for China and the world,” primarily

because of the potential crippling of TSMC. He explains very well why in this

article: https://www.jonstokes.com/p/why-a-chinese-invasion-of-taiwan. When asked about the risk to TSMC

of a Chinese invasion, one investor/analyst stated that the investment

portfolio wouldn’t be top of mind in such an event, the implication being that

the invasion would presage World War III. After reading Jon Stokes’ article,

one could envision a more nuanced set of outcomes, though it would be safe to

say that the value of TSMC’s business would be significantly and almost

certainly negatively impacted by a China invasion. But I also think that this

is a very top-down risk, whose probability is very difficult to accurately

estimate, especially by equity investors, and the overestimation might be

behind some of the gap between price and value.

Martin A.

[1]

RoIC = EBITt*(1-Tax Rate)/((Invested Capitalt + Invested

Capitalt-1)/2); Invested Capital = Total Assets – Cash &

Equivalents – Payables

[2]

Assumes 50% Dividend Payout Ratio (as % of Net Income) in FY22-FY25; ignores

dividend in Compounded Return calculation

[3] All

the buzzwords – 5G, AI, Autonomous Vehicles, EVs, cloud migration etc.

[4] https://www.technologyreview.com/2021/10/27/1037118/moores-law-computer-chips/

[5]

Gate costs can be used as a proxy for transistor costs

[6]

Per TSMC’s earnings calls

[7]

See SemiAnalysis for a very informative introduction to advanced packaging: https://semianalysis.substack.com/p/advanced-packaging-part-1-pad-limited

[8] As

evidenced, for instance, by the partnership between Applied Materials and BE

Semiconductor

[9]

FEOL = Front-End Equipment; BEOL = Back-End Equipment

[10] These

prices circulate on the internet and are somewhat backed by my wafer $ASP

estimates in Exhibit 10

[11] https://www.wsj.com/articles/tsmc-starts-shipping-microprocessors-to-apple-1404991514

[12]

Presented at the TSMC Tech Symposium 2021

[13]

Logic chips, for example, are still sold if some of the chip’s cores are

defective/non-functioning; they are simply sold at the price of chips with a

lower core-count, according to how many cores are functioning.

[14] 7 Powers: The Foundations of Business Strategy by Hamilton Helmer

[16]

For a very informative discussion of cycle times: https://semiengineering.com/battling-fab-cycle-times/.

The throughput discussion mostly used this article as a reference.

Коментари

Публикуване на коментар